💡 What is Market Sizing?

Market sizing is a crucial method for you to evaluate the revenue potential of your product, service, or business opportunity by analyzing the size of your target market.

This guide focuses on estimating the total potential revenue or market share using three key concepts: Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM).

🚀 Why is Market Sizing Important for Founders?

Market sizing is a vital exercise as it provides a clear understanding of the revenue potential and market share for your offerings and serves as a make-or-break factor in making informed “go or no-go” decisions for your business model. By accurately estimating the market size, you can make informed decisions, set realistic goals, and tailor your strategies to achieve a sustainable and profitable venture. Properly estimating your market size will help you to gain:

- Decision Clarity: Quantifying market potential empowers you to make informed “go or no-go” decisions, ensuring alignment with a viable and lucrative market for long-term success.

- Investor Appeal: Market sizing enhances investment attractiveness, enabling you to present well-informed cases to potential investors, boosting the startup’s appeal significantly.

- Operational Alignment: Assessing operational viability becomes seamless with market sizing, aligning proposed operations with the size and characteristics of the target market for sustainable product/service delivery.

- Resource Optimization: Knowing the market size aids efficient resource allocation, preventing wastage by directing efforts toward areas promising the highest return on investment.

- Risk Mitigation: Market sizing helps identify and mitigate potential business risks, allowing proactive implementation of strategies against competitive threats, changing market trends, or unforeseen challenges.

- Adaptive Strategies: Insights from market sizing inform strategic pivots, guiding adjustments in target audience, product features, or exploration of alternative market segments for increased chances of long-term success.

🗒️ Market Sizing Step-by-step

This guide offers a straightforward walkthrough, providing actionable steps to help you estimate your market size. Following these detailed guidelines, you can navigate the complexities of market sizing, ensuring a robust understanding of your market’s potential and laying the foundation for informed decision-making and strategic planning. Let’s dive into it!

✅ Step A: Identify the Market

- Define your Target Market Segments: Begin by specifying the target customer group(s) your startup aims to serve. Describe your customer segment(s) utilizing criteria like geographic (e.g., region, country, urban/rural), demographic/firmographic (e.g., age, gender, income, company size, industry), behavioral (e.g., shopping habits, decision-making patterns, buying channels), and psychographic variables (e.g., lifestyle, interests, values). Distinguish between B2B and B2C markets, tailoring segmentation variables to each. This step lays the groundwork for understanding your market scope and demographics.

✅ Step B: Case Structure & Variables

- Define Case Structure and Variables:Begin by establishing the structure of your market sizing case and identifying the variables that influence market size. This foundational step guides subsequent data collection and calculations.

- Break Down Potential Customers (TAM, SAM, SOM):

- TAM (Total Addressable Market): Determine the number of consumers falling within your target segment based on geographic criteria (country, region, city) and demographic/firmographic segmentation.

- SAM (Serviceable Addressable Market): Identify the percentage or number of consumers interested in your product or service, exploring indirect data sources for insights.

- SOM (Serviceable Obtainable Market): Estimate the number of consumers likely to choose your brand over competitors, considering marketing channels and making realistic assumptions.

- Define Variables for Average Spend per Year: Determine the variable you will need to calculate average spend per year by considering available data on consumer behavior, purchasing volume, and average pricing e.g. based on competitors prices. Also consider adjusting for seasonal variations if needed.

✅ Step C: Collect Relevant Data

- Utilize Existing Customer Data: If available, review information gathered during any previous customer research, extracting relevant insights and data. This step ensures that insights obtained directly from potential customers are factored into your market sizing analysis.

- Online Research: Conduct thorough online research to gather additional data and market insights. Leverage a variety of sources to enhance the robustness of your data collection and analysis.

- Explore Public Information: Tap into publicly available resources for population, industry, and consumer data. These resources act as valuable supplements to your findings, providing a broader context for your market analysis.

✅ Step D: Market Size Calculation

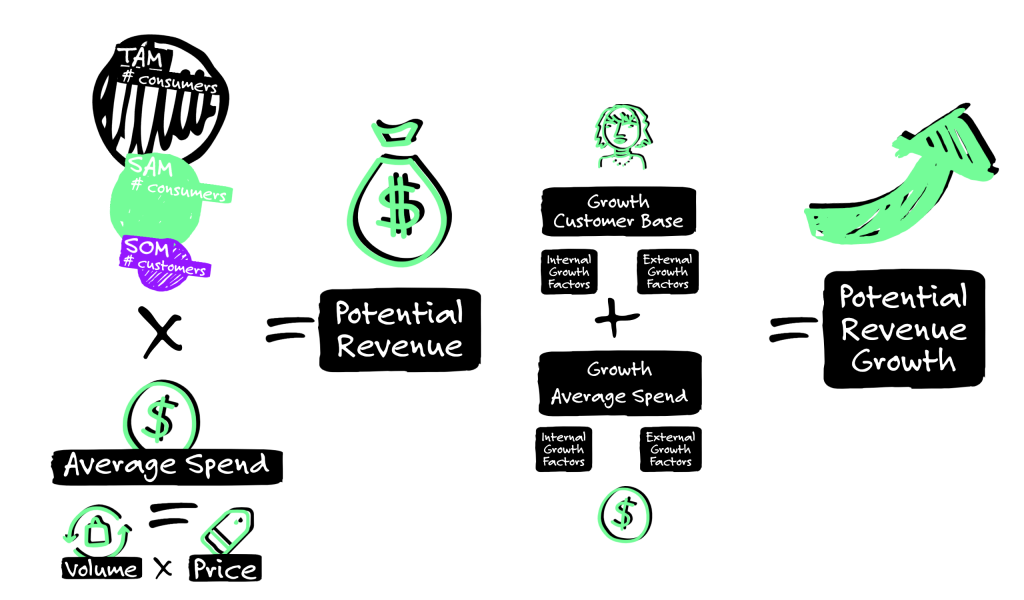

- Calculate TAM, SAM, and SOM: Utilize the gathered data to calculate the Total Addressable Market, Serviceable Addressable Market, and Serviceable Obtainable Market. This step provides a numerical framework for understanding the scale of your market opportunity.

- Determine Average Spend: Identify the average spend per year based on available data, considering variables such as product/service pricing and competitor data. This insight is crucial for estimating potential revenues.

- Multiply for Potential Revenues: Multiply the average spend by the potential customer base to estimate potential revenues in the first year. This final calculation offers a tangible figure for your market’s revenue potential.

✅ Step E: Growth Projections

- Apply Growth Rate to Customer Base: Estimate the growth rate for your customer base over time, factoring in external factors like industry growth. This forward-looking analysis considers the evolving landscape of your potential customer base.

- Apply Growth Rate to Average Spend: Project the growth in average spend per customer, considering factors like customer loyalty and increased brand affinity. This projection provides insights into the evolving spending habits of your customer base.

- Calculate Weighted Average Growth Rate: Combine external and internal growth factors, assigning weights to each, and calculate the weighted average growth rate for a comprehensive projection. This holistic approach ensures a nuanced understanding of your market’s growth potential over time.

In conclusion, market sizing is a critical aspect of your startup journey. By following the step-by-step guide you will gain valuable insights into your market’s potential, make informed decisions, and strategically plan for sustainable growth.

Get Ready-to-Use Templates and Practical Guidances . 🚀

Check out our basecamp for founders for practical guidance and templates on Market Environment Analysis and many more business building methodologies.